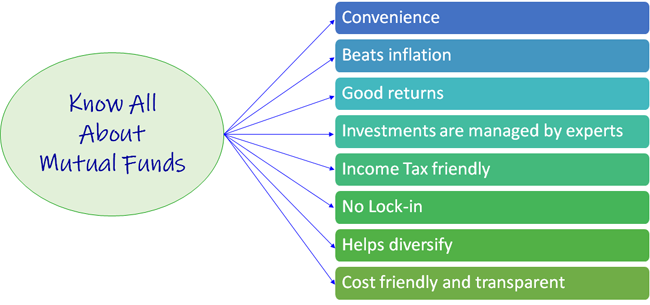

Investments in mutual funds help you build your wealth by participating in opportunities available in the markets.

Start Investing Early

It is important for you to start investing early in order to get the maximized end returns. Below example will show you why you need to start early:

Let us assume Harish and Sameer are two friends. Both friends invest Rs. 1000 every month, earning interest at 8% p.a. on a monthly compounding basis. The only difference is that while Harish started his investment at the age of 25, Sameer started investing at the age of 35. They held on to their investments till they turn 60. Harish’s investment had grown to Rs. 22.94 lacs whereas Sameer’s investment could only grow to Rs. 9.5 lacs.

From the above example, you can clearly see the advantage of investing early. No doubt Harish had extra 10 years to invest but the final amount at 60 years of age was much bigger for him.

- The Power of Long-term

Mutual Funds offer schemes of various tenures, but as you can see from above, there is a special advantage with long-term investments and that advantage is due to the effect of compounding. Albert Einstein had called compounding as the mankind’s greatest mathematical discovery, the 8th wonder of the world!

So, what do we mean by compounding? Explained in simple terms, compounding is when the interest you gain on your investments is reinvested back in the fund. Every time this happens, your investment grows, making way for a systematic accumulation of wealth. Effectively, your investment starts to snowball, multiplying as it goes along.

In the above example, a small amount of Rs. 1000 invested every month at an interest rate of 8% for 35 years gave Harish Rs. 22.94 Lacs!! That means his investment of Rs. 4.2 Lacs would have snowballed more than five times over!!!

- Start with Yourself

Investing in a way is very personal in nature. Your needs and desires are specific to you, and therefore what works for you may not work for your relations or your friend.

The investment market is constantly evolving and the large number of options and alternatives available can confuse even an experienced investor. There is always a conscious need to avoid risks and choose an option that delivers positive returns. We help you by evolving a sound financial plan for you, using Mutual Funds and other investment products as required.

We offer advice on Equity Mutual Funds, Debt Mutual Funds, Liquid Funds, Hybrid and other category of funds. The schemes advised and the portfolios designed by us are in sync with the financial goals of our clients. Our mutual fund portfolio help our clients beat the market volatility and enable them earn a decent return on their investments.

Call us to take you on a fantastic journey of wealth creation for you.